eCerts Program

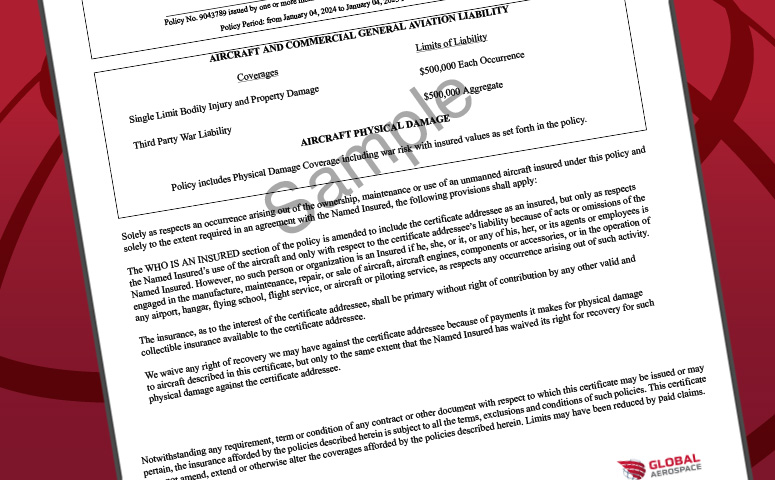

As a leader in aerospace and aviation insurance, Global Aerospace is the only insurance market that allows policyholders to issue Certificates of Insurance (COIs) online in a secure environment—24/7/365 from anywhere in the world.

Instant eCert Access Through MyGlobal

U.S. Certificates accessible from our MyGlobal portal include:

- DD2400

- EU, Germany, Italy, Hong Kong, Commercial Canada, Private and Commercial Mexico

- OST6410

- Charter Client Additional Insured

- Lienholder

- And many more

Maximum Convenience With eCerts

Our eCerts program provides:

- Ability to issue and print Certificates of Insurance

- 24/7 worldwide access

- Access to aircraft schedules

- Ability to store policy documents securely

If you would like further information about eCerts or want to set up an account, please email ecerts@global-aero.com.

eCerts Canada

eCerts Canada for Canadian brokers and their clients available through MyGlobal, has the unique ability to issue and print insurance certificates 24/7/365 from anywhere in the world. Territorial boundaries and timing issues no longer prevent Global Aerospace Canada or the broker community from providing immediate service to their clients.

eCerts Canada certificates available for use include:

- Canadian Transport Agency Certificate

- Transport Canada Certificate

- Additional Insured Certificate—Aircraft Liability Only

General Additional Insured Certificate—ability to evidence the following contractual requirements:

- Notice of cancellation (notice period subject to policy wordings)

- Primary and noncontributory coverage

- Invalidation of additional insureds

- Contract-specific increased liability limits (subject to maximum policy limits)

- Cross-liability coverage/severability of interest

- Hold harmless indemnifications