Weather Events: Impact of Natural Catastrophe Events on Aviation Insurers

Aviators and insurance professionals both keep a keen eye on weather, although often for very different reasons. During 2020, almost everyone was paying particular attention to what was ultimately record-breaking Atlantic hurricane activity.

The Obvious. At the time of this writing, there have been 29 named tropical or subtropical cyclones, 12 hurricanes and five major hurricanes. Of the 29 named storms, 12 of them made landfall in the contiguous United States, breaking the record of nine set in 1916. The strongest of these was Laura, which clocked maximum sustained winds of 150 mph. Total seasonal damage estimates from these storms are in the neighborhood of $40 billion USD.

The Not So Obvious. Hurricanes are widely covered events for two very good reasons. The first is they do tremendous damage and cost lives. Tragically, over 300 lives were lost during the 2020 Atlantic hurricane season. The second reason is they are reasonably predictable, which also explains why they end up being relatively low-impact events for aviation insurers, at least when compared to other weather-related events.

When a hurricane approaches, aviation clients are often able to evacuate equipment or, at the very least, take alternative action to mitigate damage. That’s not to say hurricanes don’t register—they most certainly do. However, their impact is not to the scale of other weather events.

A Case Study in Large-Scale Loss

On March 3, 2020, a tornado stuck John C. Tune Airport in Nashville damaging many aircraft, most beyond repair. The EF2 tornado (with peak winds of 111 to 135 mph) struck at 1:00 a.m., a time at which most aircraft would probably be on the ground. It hit close to terminal buildings and destroyed a series of hangars.

Market estimates are 92 damaged or destroyed aircraft, with a total sum insured of $110 million USD and damage estimates after salvage approaching $100 million USD. The bulk of the damaged aircraft by number was piston powered with 74, plus 11 turboprop, 17 jet and three rotor wing aircraft affected. In terms of insured values, the jet aircraft made up 60% of total damage with another 28% stemming from the turboprops.

FAA data on the airport would suggest that 154 general aviation (GA) aircraft are based at this airport. By that measure, 60% of the aircraft based at the airport were impacted by the strong winds.

The event affected 13 GA insurers, with numbers of insured aircraft ranging between one and 18. It, thus, was a true market event. Clearly the high-value jets are driving up losses for individual insurers, but overall, we would assume this event will cost between 5% to 10% of most insurers’ gross written premium, so it does make a dent in the annual result when this comes on top of “regular” losses.

The Surprising Numbers

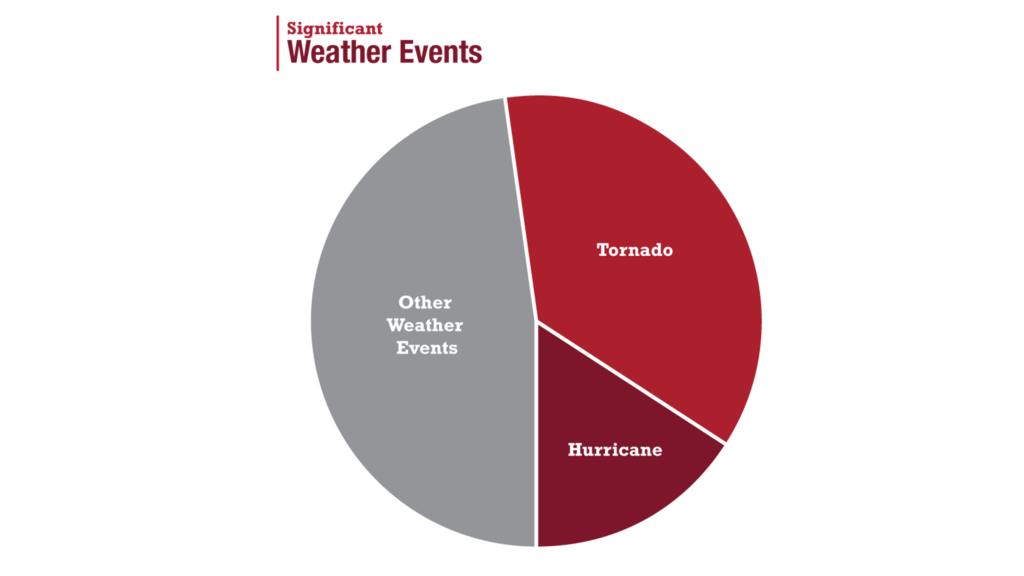

As this event illustrates, our data indicates that hurricanes, while highly publicized, make up the smallest portion of ground weather-related hull loss events for aviation insurers. Approximately 40% of ground hull loss activity due to weather perils arises out of tornados, while almost 50% arises out of hail or flood events and the remaining balance comes from hurricanes.

Also surprisingly, many—if not most—of the high-valued hull claims that arise out of tornados are the result of hangar collapse. It would seem counterintuitive that hangaring your aircraft during bad weather is risky, but in the case of tornados, it certainly seems to be. While modern hangars are designed to withstand strong winds and should certainly make a difference in the assessment of hail exposure, at John C. Tune Airport, the damage to aircraft was just as bad for the hangared aircraft as it was for those parked on the ramp, if not worse, irrespective of the quality of the hangar. However, in no way is anyone suggesting someone remove airplanes from hangars when bad weather is approaching! Hail is especially expensive for aviation insurers, as it is typically a widespread event affecting many aircraft at once.

Managing Risk

Underwriters manage this risk in several ways. We start by using underwriting information to distill the base of operations or heavy maintenance facilities in an effort to manage accumulation of insured aircraft. In certain instances, underwriters offer pricing incentives to attract a proper balance of hangared aircraft, and we do make an effort to assess the robustness of hangars for wind and fire perils (notwithstanding the peril of hangar foam events which is covered elsewhere in this publication).

In many cases, underwriters incentivise the evacuation of aircraft for hurricane perils and we also price for enhanced risk based on specific location perils. In hurricane-exposed areas, underwriters apply deductibles for spares coverage, and in every case, underwriters make certain insured values are both accurate and reasonable.

Beyond the rating of single individual risks, however, managing this exposure at the portfolio level is key and having an understanding of total accumulation by region is a must. But due to the movable nature of the risks underwriters insure, the base airport can only ever provide a likely scenario of the values exposed in such an event anyway.

Next to the tornado in Nashville, airports were also struck in Jonesboro, AR, on March 28, Monroe, LA, on April 12, and Walterboro, SC, on April 13. The assumption that aviation losses happen independently from one another does not apply for such exposures and thus will continue to challenge aviation insurers moving forward.

Text: Walter Voigts von Forster, Munich Re

Photos: Eric Weidner, McLarens Aviation