Safety Update: The Case for Reconsidering Unpriced Exposures

When people think of aircraft insurance, what typically comes to mind is cover for accidents, hard landings and the like. In fact, most “technical” pricing of aircraft insurance uses only operational statistics and basic exposure data points (aircraft values, passenger numbers, etc.) to determine equitable premiums.

However, aircraft insurance is also affected by a far-wider range of non-operational perils that are currently not accounted for in insurers’ pricing. Could this be a burgeoning problem?

Pricing insurance on every conceivable peril would be needlessly complex and arduous. But issues arise when such unpriced exposures become more prevalent over time and consistently erode premium from the market, which has been geared toward setting premiums based on traditional operational losses.

The Evolving Perils Caused by Climate Change

Climate change affects a wide range of covered perils for the entire insurance industry and aviation is no exception. Increased frequency of extreme weather events has the potential to erode premium from the market more consistently today and in the future than it has in the past.

One clear manifestation of this evolving peril that we have seen in the past 12 months is the increase in aircraft damage caused by severe hailstorms. Historically, major hailstorm events affecting multiple aircraft on the ground have rarely exceeded USD10 million in total for aircraft physical damage claims. The Nashville, TN area tornado in March 2020 alone is estimated to have caused over USD100 million in aircraft damage at area airports. Hailstorm claims for 2021 are anticipated to exceed USD100 million spread over multiple events throughout the world with some heavy losses to airline aircraft in the United States. No doubt this figure is partly inflated because of more parked aircraft in the wake of the pandemic but the trend is identifiable nonetheless.

Expert Insights on Weather Changes

We investigated the science around changing weather patterns with the help of Paul D. Williams, professor of atmospheric science at the University of Reading in the U.K. Professor Williams says, “There is emerging scientific evidence that climate change will increase hailstorm severity across most of the world, even in regions such as North America where overall hailstorm frequency is projected to decrease. Although significant uncertainties remain, we can see clear trends and patterns that support the hypothesis of more severe hail events, with correspondingly higher losses associated with them.”

This issue is not, of course, constrained to the aircraft insurance space. Ask any property underwriter if they believe they have fully priced or accounted for the increase in frequency and severity of weather events such as flooding, hurricanes and wildfires in recent years and the answer is likely to be a resounding “No.”

So, it becomes imperative for insurers to ask themselves if they are technically pricing their products on issues that are current and growing rather than on the data that has been used historically.

But this is not the only new and emerging pricing trend that aviation insurers should be focusing on. We also need to understand the fundamentals of the expected frequency and severity of claims in light of changes in safety data.

The Safety Improvement Plateau

Air travel continues to be the safest form of long-distance transport. In 2018, the fatal accident rate was equivalent to one fatal accident every 4.2 million flights (IATA).

Technological, human and cultural change factors have all led to this staggering improvement in a relatively short time frame, and the focus on continuous improvement in this area is rightly unrelenting.

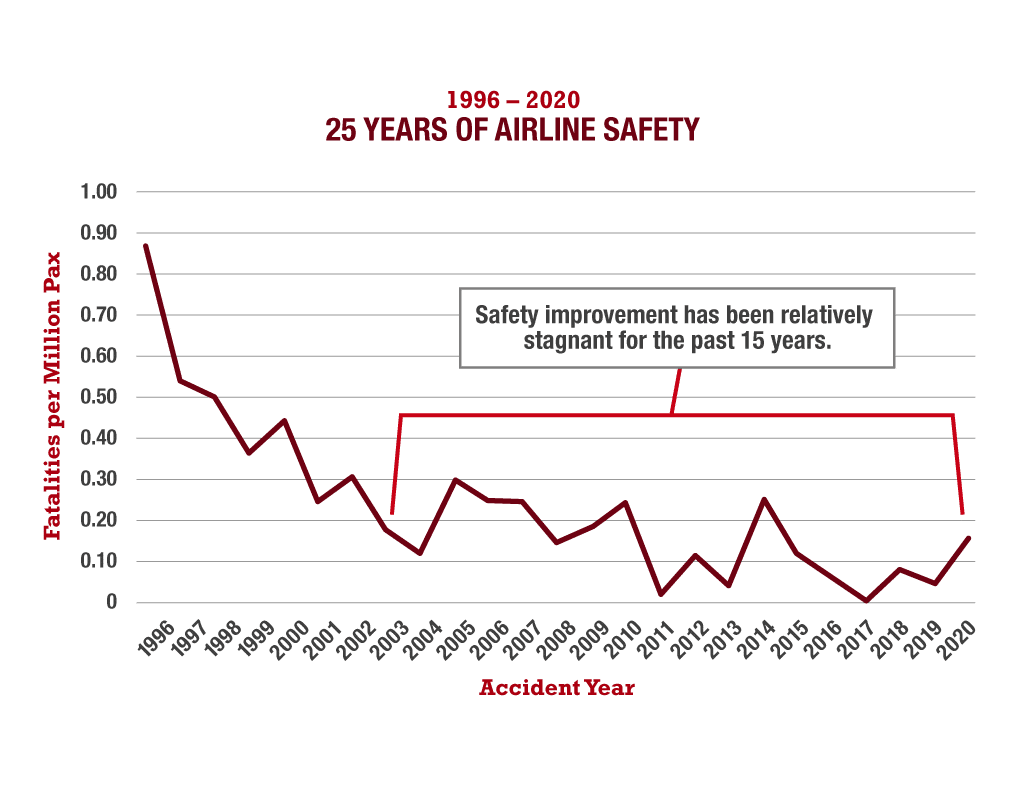

However, in the past 15 years, there has been a plateau in these improving statistics. Admittedly, when you reach these very low incident rates, the statistical relevance of the 15-year picture could be questioned given the impact a single fatal accident can have on the numbers or trend.

But why is this long-term trend of interest to aviation insurers? Rightly or wrongly, insurers have been accustomed to using the assumption in their technical pricing that aircraft accidents and/or fatal losses are decreasing in frequency over time.

This projected drop in frequency helps to offset trends around rising claims costs. These higher costs manifest themselves through increased passenger liability awards and by increased aircraft damage repair costs, such as repairing composite materials.

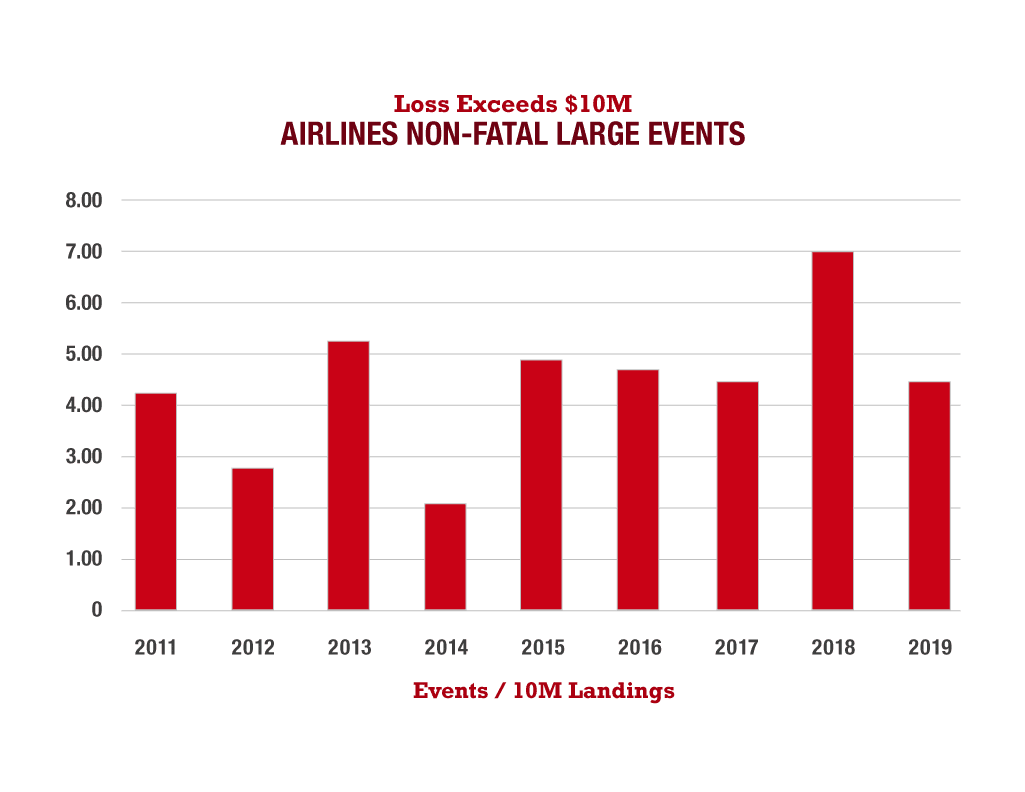

Plateauing safety along with rising claims costs can also be seen in the chart below, which shows the number of large events in the airline sector in recent years.

Is It Time to Challenge Long-Held Assumptions?

Improvements in aviation safety have been marked, and they are a credit to all industry stakeholders. No doubt safety advances will continue, but they are likely to be less significant, at least statistically speaking. This reality, coupled with evolving climate change, suggests perhaps the time is now to refresh some widely held assumptions. Safety culture and continuous improvement will always be at the forefront of the industry’s mind. But for aviation insurance products to remain relevant for all, we must acknowledge the leveling off of safety data and incorporate new and emerging perils into our pricing.

After all, insurers also should be focused on improvement to—and relevance for—the insurance products we supply to our clients.